Welcome to freelancing! It’s one of the biggest, most exciting career moves you can make, and the rewards can be just as huge.

More flexibility to live on your own terms, to be no-one’s master except your own – to work how, when and where suits you. An enticing prospect, sure, but is independence all it’s cracked up to be?

The Ultimate Guide to Going Freelance reveals the good, the bad and the ugly of working for yourself, showing you how to get started, thrive and build for the future. Think of it as your roadmap to success.

We’ll take you through how to become self-employed, landing your first freelance gig and more, with handy checklists along the way.

So if you’re looking for practical advice, encouragement and the unvarnished truth about going it alone, let’s begin.

To freelance or not to freelance?

Being independent and making money doing what you love can enable a wonderful lifestyle full of freedom and opportunities.

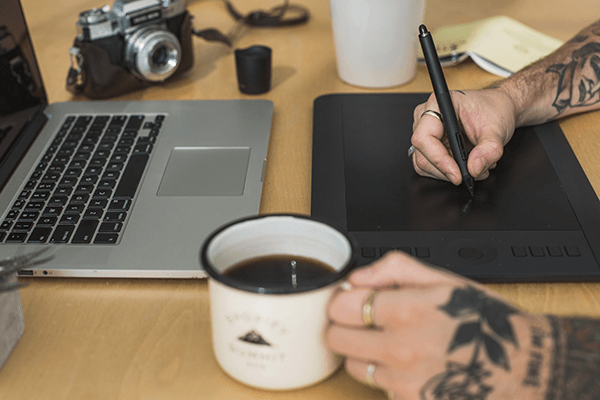

People in the creative and technical industries have made lucrative, fulfilling businesses out of going freelance.

Yet it’s also important to note that not all freelancers turn their dream into a stable career. Should you take the risk? Here are some things to consider:

This may sound screamingly obvious, but are you completely certain what freelancing actually is?

A basic freelance definition is being your own boss. Instead of being employed by a company, with all the standard benefits like pensions and holidays, you employ yourself.

Your income comes from multiple clients who hire you to deliver services or products. You can work on as many projects, with as many organisations as you choose.

As well as managing your time, tasks and customers, you are also responsible for all administration such as billing and taxes.

To ensure your expectations are accurate, ask yourself ‘what is freelancing?’ and check you understand the job description.

Be honest about whether the idea has legs. Thoroughly research the market and decide if there’s enough of an appetite for what you plan to provide. If you’d be entering a saturated, fiercely competitive arena, are you prepared to fight for freelance jobs?

Launching your own business requires investment both in time and money, so you’ll need to be in a secure enough financial position to get by without your regular income.

We’ll walk you through the deeper financial aspects like start-up costs and calculating your rates later in this guide, but it’s crucial to know up-front that very few get rich quick in the freelancing biz.

While there is help for self-employed workers out there, the early days can be slow. Even when established your earnings can fluctuate. A contingency fund to cover liabilities (i.e. rent and bills) is therefore vital.

Countless people have set up for themselves through exasperation with their current career or serving ‘the man’ in general. Sometimes that motivation is enough to drive you, though it can also be a shaky foundation for success…

Examine why you’re unhappy in your current occupation and look objectively at how working for yourself would resolve this.

What is self-employed life going to offer that makes it worth the effort? If you’re sick of the schedule and constraints of the 9-5, you may find some of the freedom you’re craving, but don’t expect a world of leisure.

You get out what you put in, and only those willing to give everything to their venture are going to make it.

Are you the type of person who can motivate themself to stay on schedule without someone breathing down your neck? One of the fastest ways to lose custom is to miss deadlines, so you must be organised.

Do you have the drive and confidence to put yourself out there and handle criticism? Freelancers need to put in the sweat and hustle, often more than those with ‘regular’ jobs.

Reflect on whether you’re prepared to chase the work. There’s also no room for fragile egos, and it takes a thick skin to accept rejection and that not everyone will love everything you do.

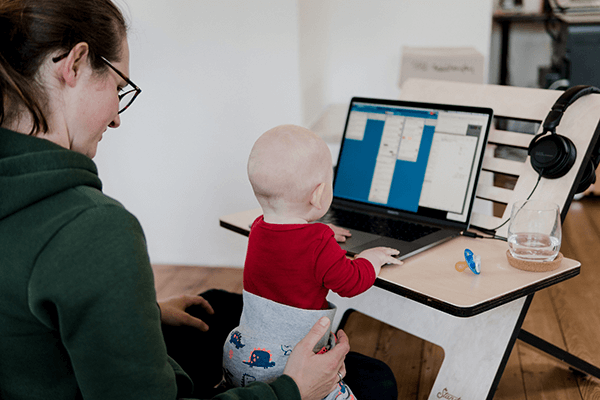

Most of us struggle to balance our career and personal spheres, and you may be looking at freelancing to find some equilibrium.

Granted, self-employment can provide greater flexibility to arrange your work around home commitments, but the two will inevitably collide.

It’s important to decide if you can give your business the energy it needs.

Bear in mind that clients can place hefty demands on your time (and often at unsociable hours). If you have dependents such as young children at home, can you stay on track and not get distracted?

When to go freelance

As with most major steps in life, from starting a family to buying a home, there is no ‘perfect moment’ to go freelance. We’ll cover further influences on your timeline later in the business plan section, but some key points to consider are:

1. Your career stage

There’s a huge range of skills and experience out there in the market, and these attributes will affect your business’ performance. While this isn’t to say that less seasoned professionals can’t be wildly talented and committed, you should begin by thinking seriously about whether you’re ready yet.

2. Your finances

Do the sums! As well as shelling out on set-up costs, going freelance means balancing your potential gains with the lack of regular employee benefits, like a reliable income, sick pay, company pensions and paid holidays.

Wait until you’re sufficiently financially prepared, in case of a slow take-off or dry spell, and factor in any significant upcoming life changes demanding extra security. For instance, a new baby or house move.

3. Your transition plan

There’s no rule saying you have to go full-time with freelancing straight away, or ever, and many choose to hedge their bets by doing projects ‘on the side’.

There are plusses and minuses to both approaches. Your plan will depend on your finances, your personal responsibilities, the field you are working in, and your appetite for taking chances.

Option A: Jumping straight in

The ideal scenario is being able to devote every minute to your business, pouring everything into laying the foundations, branding, building a client base, buying paperclips and everything else that needs doing.

Even if this doesn’t turn a profit straight away, it will help get you off to a quicker start and enable you to able to take on more contracts.

Option B: Moonlighting

Unfortunately, not everyone is able to jump right in, so an alternative route is to begin by doing freelance work ‘on the side’. If you’re currently employed, you could gradually reduce your hours and test the water before making a full-time commitment, balancing risk and reward.

While moonlighting is arguably the safer option, it does mean that your business may take longer to get off the ground, and you’ll have to juggle two jobs.

How to go freelance

Your brain is buzzing with ideas about your new venture, from the exciting contracts you’ll win, to the logo on your letterhead. To turn these thoughts into reality, you’ll first need need a business plan, refining your proposition and developing a strategy for success.

We’ll take you through a ‘how to become a freelancer’ checklist, outlining the main tasks to complete before letting yourself loose on the world.

Creating a business plan

Business plans differ across industries and it’s a good idea to research templates aimed at your particular field. But in general you should lay out the following:

1. What is your business?

Paint a clear picture of what you want your business to be. If you can’t describe it in one sentence, your vision could do with some refining.

- What products or solutions will you deliver? Do you want to create a full-service organisation, or just focus on one specific thing?

- What are your USPs, what makes you special and different you from your competitors?

- Do you hope to remain a solo act or lay the foundations for an empire, with multiple employees of your own?

2. Conduct a thorough SWOT analysis

A SWOT analysis provides a top-level view of your business, identifying its durability as well as challenges it will face.

- Strengths, e.g. a unique proposition

- Weaknesses, e.g. little management experience

- Opportunities, e.g. market boom

- Threats, e.g. tough competition

3. What do you plan to achieve?

Set a handful of goals and objectives to guide your performance monitoring. Again, these will vary depending on the nature of your enterprise, and might include:

- A forecast of when you’ll break even and turn a profit

- A target for how many clients you’ll secure within the first year

4. Who is your audience and market?

Identify who will be interested in your services and how much business is out there, then assess the competition.

- What sectors will you target, and why? Build some audience personas, identifying what challenges you can help them overcome, and whether they offer sufficient revenue.

- Summarise the market size and traffic. Are you entering a buoyant, growing arena? How saturated is the industry? Will you be a big fish in a small pond, or vice versa?

- Are there any significant market trends that will affect the future of your venture?

- Identify your competitors and compare how their strengths and weaknesses stack up against yours. You should also analyse how much of the market they currently occupy – is there an underserved area you could target?

5. Outline all setup and operational requirements

Look at how the business will operate day-to-day and list everything you’ll need, both to launch and going forward.

- Assess your capacity. How many projects can you handle? If you’re fortunate enough to land multiple gigs, make sure you don’t overreach and let down clients.

- Consider your infrastructure – what facilities and equipment are needed?

- Map out the necessary operational systems, from accounts and sales to IT and quality control

- List any regulatory standards to which your organisation must conform

6. State your rates

This is such a sticky subject that we’ve devoted a whole section to it later: freelance rates. As a quick overview, your business plan requires a rate card listing your products and services, and how much you’ll be charging for each.

7. Finances and legal

Again, we’ll expand on this later, but the basic idea is to find out:

- What financial return do you anticipate?

- How much admin is involved, for instance tax and accounting?

- What type of business are you setting up, i.e. sole trader, Ltd, partnership?

Tip: Be brutally honest when writing your business plan. It’s great to think big, but overly optimistic forecasting can jeopardise your future finances.

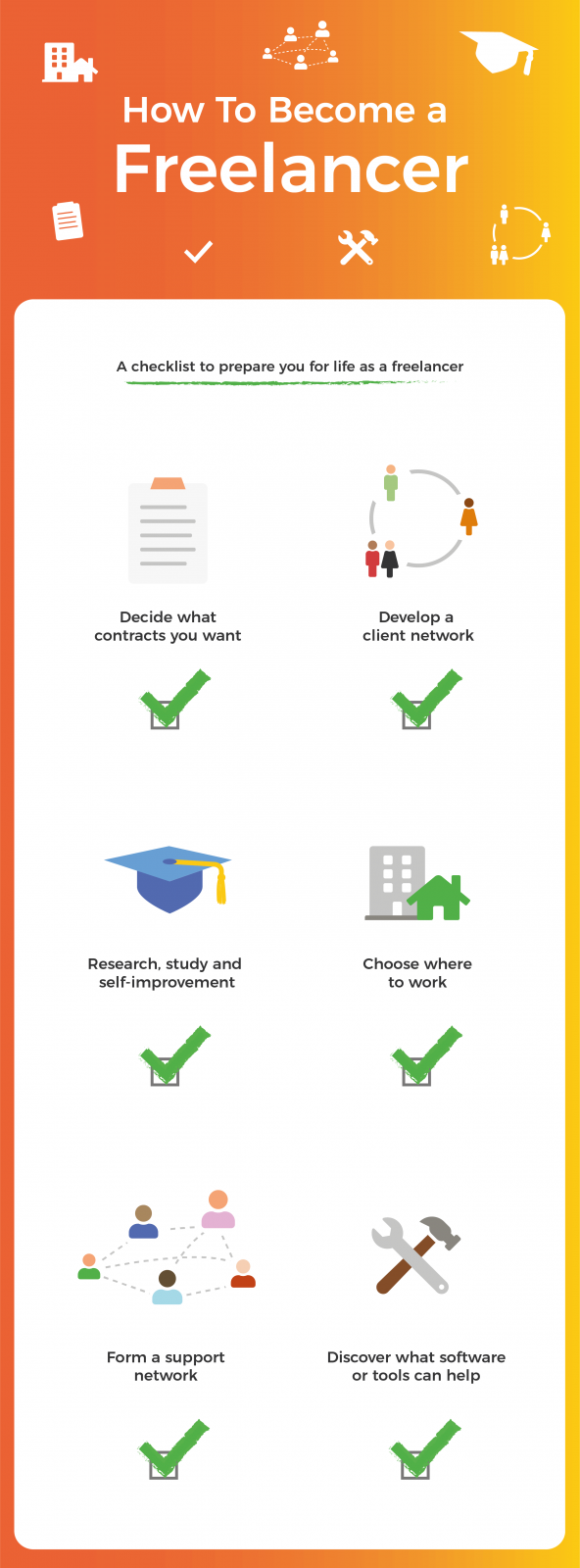

‘How to become a freelancer’ checklist

With the business plan under your belt, you know where you’re going and can move on to the to-do list:

Decide what kind of contracts you want ✔️

Freelancers can take on a range of contracts, both long and short-term, paid by the hour, day or project. Each has its pros and cons, depending on the nature of your organisation and how you prefer to operate (see How Much to Charge section).

Develop a client network ✔️

Where will you sell your services, and to whom? How to find freelance work differs by sector and there are countless ways to build your ‘little black book’ beyond marketing, but here are a few tips:

- Leverage your professional network. Ask for people’s help in getting the word out and recommending leads – even if it’s simply reaching out on LinkedIn.

- If you’re selling commodities, discover where your target audiences buy these, including websites and brick-and-mortar stores.

- Join dedicated freelancing websites like Upwork, PeoplePerHour or Worksome. These can provide access to opportunities or customers you otherwise wouldn’t have. A downside is fierce competition, which can drive down fees and make it harder to secure gigs. Recruitment agencies can also connect brands with freelancers, so do some research into those focussing on your sphere.

Research, study and self-improvement ✔️

You’re setting up shop because you’re brilliant at what you do, yet there’s always room for improvement. This is the time to go through your professional skills and knowledge with a fine-tooth comb and identify any gaps.

- Keep up to date with industry news and insights to position yourself as a thought-leader at the forefront of your field, pulling ahead of competitors and meeting evolving consumer needs.

- As well as your area of specialism, assess if you have the wider expertise necessary for running your business, e.g. administration, communication and customer service.

Choose where to work ✔️

Will you base yourself at home or rent an office space? Each has its advantages, but your decision should explore:

- Your finances. Can you afford to hire premises, or would those funds be better funnelled into growing your enterprise?

- Your personality. Freelancers often work alone, which can be liberating if you aren’t a ‘people person’, while those who become distracted or lonely without company might benefit from a shared space.

- Your operational requirements. Do you need specific facilities, like a studio?

Form a support network ✔️

Nobody knows everything. There will come a point where you want guidance or advice. Think about who could assist in these scenarios, whether it’s a fellow independent, a former colleague or a professional mentor.

Finding your Obi Wan can make all the difference to your confidence and business success. So don’t be shy about asking for support.

Discover what tools or software could help ✔️

As a freelancer you’ll be wearing many hats, from admin to marketing. Fortunately, there are a host of solutions available to take the hassle out of these tasks and maximise efficiency. These will vary by profession, and could include:

- Workflow tools, encompassing project management, scheduling and productivity. These organise all your commitments and deadlines in one place, ensuring nothing gets missed.

- CRM (customer relationship management) systems. In addition to coordinating all contacts and leads, these allow you to record every interaction and transaction, alongside sales forecasting and analytics.

- Accounting tools (see Finance and Legal section).

- Marketing software (see Branding and Marketing) section.

- Out-of-the-box business solutions like HostShop, which take care of multiple processes such as billing, support and communication.

Here’s the checklist summarised:

Branding and marketing

Now that you’re on with building your freelancing business, you want people to know about it! That’s where branding and marketing come in.

These are huge subjects which demand a lot of attention, but here’s a summary of the basics for crafting your image and promoting your business.

How to create and promote your brand

Before you can market, you need to brand. Branding defines your business, products and services, forging a unique identity and conveying what makes you special.

It’s the personality of your business: the character that connects with customers’ hearts, minds and wallets, and shapes how the market perceives you.

Marketing publicises your brand’s offering, communicating messages that convince people to engage with or buy from your business.

- Identify who you’re targeting (see Business Plan). This informs what image you should project and what feelings to evoke in order to engage your audience most effectively. Are you fun, informal and accessible? Aspirational, sophisticated and exclusive? Small and personal, or a larger organisation?

- Research the market – what are your competitors doing, how do they brand themselves, and what will you do differently? What advantages and USPs can you highlight?

- Your business’ reputation is a key part of your brand, so identify its values. Are you all about the bottom line? Do you give back to your community? Also, what do clients say about you? Are you reliable and proficient? Is your customer care the best around? Your reputation is inextricable from your brand, driving or prohibiting referrals, and it takes a lot of work to rehabilitate your image after delivering a poor product or service.

Tip: Whatever identity you settle on, keep it consistent. A sloppy approach to branding will limit your market visibility and reflect poorly on the professionalism of your outfit.

- When you’ve found your niche, combine all these elements in a signature style by creating your promotional materials, including:

- Business name. Whatever you may have seen on The Apprentice, keep it relevant, memorable, short and easy to spell. When you register with HMRC, you have to conform to certain naming rules, and it’s advisable to trademark. You’ll also need to secure a suitable web address, so check 20i domain names to ensure what’s available fits with your branding.

- Logo. Like your business name, this should represent your brand as well as being appropriate for your audience. It’s a good idea to hire a graphics expert to design your logo, as it reflects on your image and helps customers remember you.

- Brand design scheme. Any public-facing business materials must appropriately articulate your brand through the fonts, colours and aesthetic you choose.

- Tone of voice/editorial guide. Besides examining how you look, think about how you want to sound. Will you use formal, elevated language, a down-to-earth, conversational tone, or something else?

- Website. The big one, in which you should invest as much resource as possible. Your website is central to driving business and can put off prospects if done poorly, so it’s advisable to have a professional design one for you.

Your website is your shopfront, the place people look for an understanding and feel of what you offer. It’s a hub for information, inspiration and conversion. Feature a portfolio of your previous work, reviews from clients and other materials that showcase your brilliance.

Again, websites are a huge subject demanding much research and planning, so consult as many sources as you can.

- Social media. Most people are active on social media and expect businesses to be so too. Rather than creating an account for every platform, consider which are favoured by your target audience, and direct your resources there.

- Communications. From email marketing to press releases, share a regular stream of branded communications to stay at the forefront of people’s minds, providing updates, highlighting your services and more.

- Continue to build on these branding and promotional efforts through:

- PR and outreach. Activities such as blogging, public speaking and elevator pitches can establish you as a leader in your field by demonstrating your value and expertise.

- SEO (search engine optimisation). What do you do when you want answers? You search online! SEO is the science of making yourself as visible as possible on search engine results pages. It’s an important, long-term part of any digital marketing strategy.

- PPC (pay per click) advertising. For a faster, sometimes easier, and usually more expensive way to reach people online, investigate PPC. It’s a type of digital advertising where you pay based on how many people see or interact with your ad.

Finance and legal

The bit that most of us dread! But don’t worry, the financial and legal aspects of your freelancing business aren’t as scary as they sound, so here’s a brief roundup.

The sums

It’s tough to know at the outset what earnings you’ll be taking home, though it’s wise to think about how you’ll be spending them. For example, what proportion will you treat as your ‘salary’? What will you reinvest in the company? If your start-up costs were high, how long will it take to break-even?

To answer these questions, list absolutely everything necessary for launching and then maintaining your enterprise, down to the last post-it note.

Whatever your field, there will be overheads to factor-in and you need to be clear what outlay is required.

You might want to investigate new business grants for self-employed workers or the help available from the government.

Some people choose to secure start-up business loans for setup fees, while others wait until they’ve saved enough to begin in the black.

Your budget should account for the fluctuations of a freelancer’s income, and plan for the worst-case scenario.

It’s advisable to maintain a safety net for when trade isn’t booming or in case of illness, with many putting away at least one month’s wage for financial responsibilities like bills and food.

A further calculation is how much to put aside for the employee benefits you’ll no longer be receiving, so forecast your costs to cover sick pay, annual leave and a self-employed pension fund. This amount is up to you, however a common target is 25% of your earnings.

Tax

As a freelancer, you pay tax on your profits (not your total income) and determine how much you owe through self-assessment.

In the UK, the first step is to inform HMRC that you have become self-employed, and the classification of your business:

- Sole trader. This means you work for yourself, selling goods and/or services, and are personally responsible for any losses.

- Limited company. This is legally separate from its owners, with its finances standing apart from your personal ones.

- Partnership. Like a sole trader, but sharing the profits, losses and liabilities with another person.

As most freelancers are sole traders, we’ll look at how to register a new business of this kind. While you don’t have to declare yourself a sole trader until you’ve made over £1000 that tax year, it’s a good idea to do so anyway.

This could be for occasions when you need to prove your worker status, like when claiming benefits such as Universal Credit for the self-employed.

You register as self-employed by submitting a Self Assessment tax return to HMRC. This declares your profits alongside what Income Tax and National Insurance you owe.

You can tot this up with the straightforward self-employed tax calculator on the UK Government website. Remember that freelancers pay tax annually rather than monthly, and it’s vital to budget for this throughout the year to avoid a nasty shock down the line.

Note that this is just an overview, and you should thoroughly research HMRC guidelines to keep everything above board. Before you send out any paperwork like invoices or contracts, make sure your organisation’s name and address are on there so the taxman can verify transactions.

Tip: The UK tax year runs 6th April-5th April, and the latest you can register your business with HMRC is by 5th October. If you don’t submit your self-employed tax return by this deadline, you may get fined.

Accounting

To keep your tax accurate, monitor your company’s performance and financial situation, and secure credit, you must keep detailed records of your income and expenses as you go. Again, this is a huge subject, and some key pointers include:

- Open a dedicated business bank account, which you use exclusively for your freelance transactions. As a sole trader this isn’t a legal necessity. But it’s good practice for keeping track of things, and many personal accounts prohibit business usage.

- Let accounting software such as Quickbooks or Sage do the hard work for you by automating your financial records. Alternatively, you could hire an accountant, which will make your life infinitely easier yet cut into your funds.

- Keep your accounts rigorously up to date, as freelancers are vulnerable to late or non-paying clients. Being able to immediately flag outstanding remittance will help with debt recovery.

- Keep proof of every transaction, for instance receipts, bank statements and invoices, for auditing and offsetting expenses against tax.

Tip: It’s no secret that freelancers can face challenges securing credit like a self-employed mortgage, with lenders sometimes needing a little more reassurance that you’re a safe bet. By keeping accurate records, you can provide a true picture of your financial stability and responsibility.

Insurance

The truth is that you may at some stage encounter a legal problem with your business, so insurance can be a lifesaver. Freelancers aren’t usually required to hold professional indemnity insurance, but it’s better to be safe than sorry if a client claims that your activities caused them losses or damage. Likewise, you might want to look into public liability insurance if your work takes you out and about.

You should also insure any equipment necessary for your venture, such as computers or cameras, as well as your most important asset – yourself!

Income protection and/or critical illness cover is particularly relevant in lieu of self-employed sick pay, giving you a contingency plan in case of incapacitation.

Documentation

Another unfortunate reality is that not every client is honest, so protect yourself with legal documentation.

When you’re hired as a freelancer, you may be asked to sign a contract promising that you will deliver the agreed product or service and abide by any rules they set out. Plus the conditions under which they can refuse to pay you (for example if the work is late or of poor quality).

It’s likewise good practice for you to supply your client with a contract, whereby they promise to pay you for the project and agree to terms such as ownership of intellectual property.

Though not a legal requirement, this serves as evidence if a problem occurs down the line.

You’re also obliged to have a privacy/data protection policy in place, so that you can tell the Information Commissioner’s Office (ICO) how your business uses personal information.

How much to charge as a freelancer

Deciding on your fees can be tricky. How do balance your profits and the value of your time and expertise, with securing trade in a competitive market..? There’s no simple answer.

Your pricing strategy depends on a range of factors like the type of work you do and industry norms, but there are two main approaches: time and project-based.

Time-based fees

Many freelancers set their prices by an hourly or day rate, multiplying the estimated completion period by this figure.

The advantages here are that you’re paid for every minute you put in. So there aren’t any unpleasant surprises if the job turns out to be more complex than anticipated, or if the client changes the brief.

The downsides are that if you complete the task ahead of schedule, your efficiency could end up losing you income.

Project-based fees

The other option is to charge a fixed sum per project, regardless of how long it takes. This places emphasis on its worth to the customer, who cares far more about the utility, quality and punctuality of the finished product than what it took to generate it.

For example, a graphic designer deciding how much to ask for a logo would be better off setting a flat fee. Such a crucial brand asset is valuable to the client yet would make the designer little profit on an hourly rate.

Project-based fees mean you’re more likely to earn what your efforts are actually worth and can allow a better work-life balance, as you pursue on a few big-ticket jobs instead of multiple less lucrative gigs.

Conversely, if the task ends up taking longer than anticipated, your fee still remains the same.

The going rate

Either way, you’ll need to come up with some figures. Rather than plucking these out of the air, gauge the going rate by researching what your competitors are charging, or even asking people in your professional network (not prospects) what they would expect to pay.

Your pricing should also factor in tax, overheads, expenses and that you don’t have a uniform income. So your fees will often be higher than a salaried worker’s fees.

In the early days, it can be tempting to low-ball yourself and undercut the competition to develop a portfolio and client list. However, this can affect perceptions of your brand’s calibre and won’t be a sustainable approach in the long-term. You’ll be doing extra hours for less money. Setting an appropriate rate shows that you have faith in the value your time and expertise.

Tip: Some companies try to take advantage of independents by asking them to do the work for ‘exposure’ or experience, rather than payment. This is particularly prevalent with freelance creative jobs, and you should beware of these outfits. If they engage in such shady practices, you don’t want to be associated with them.

When you know how much to charge, you can learn how to invoice:

- Clearly state your terms in your invoicing documentation, including price, terms and payment due date. Unfortunately, some customers try to put off or avoid settling up, so make your expectations transparent.

- Do it straight away. This helps you stay on top of your accounting and cashflow, while reinforcing the professionalism of your organisation.

- Consider billing a portion of your fee up-front, as a sort of deposit. Some clients might not be okay with this, but it offers you some security if they renege on the final invoice.

Your future as a freelancer

Now you know how to begin freelancing, you should start thinking about your future trajectory. Will you be satisfied with staying small? There’s nothing wrong with the answer being ‘yes’. Or will you expand?

Rather than accepting more contracts, established independents can develop their business by simply becoming pickier, selecting higher-paying work and clients.

But that is a privileged, longer-term position. If for now, growth means taking on as many projects as you can, how will you secure them?

Review how you have built your network to date. Keep doing what delivers results and leverage your previous experience by asking for reviews or referrals. Continue to put yourself out there, whether that’s through increased investment in marketing activity or participating in industry events.

Another route is to offer a wider range of services. Open access to further clients by catering for a wider range of needs. For example, if you’re a web designer, you could consider selling web hosting.

Bear in mind that expanding your services doesn’t guarantee profit, and you have to figure out if the added solutions are worth the input. Essentially, if it ain’t broke, don’t fix it.

More work or services mean more resources, so decide how you’ll manage this:

- DIY. Doing the extra stuff yourself means not sharing the proceeds and enables total control over your output, but you should assess if you have the time and energy.

- Hiring staff. Taking on some help could boost growth while making your life easier. Or if you want to provide a service for which you don’t personally have the skills, a new hire could even bring in new business. On the other hand, being an employer is a huge responsibility, so weigh up whether staff would lighten the load.

- Subcontracting. It can be useful to have someone you can call on when you can’t cope with a particular project alone, or if you temporarily require specialist input. The flip-side however is financial outlay on the subcontractor’s fee, and the gamble of trusting their output and dependability.

- Outsourcing. If you plan to delegate tasks on a longer-term basis, outsourcing can be a practical option. Many freelancers outsource their accounting, and prosperous outfits may outsource marketing or admin. Bringing in expert outside help can be a prudent move, unlocking more time to devote to what you’re best at, but takes money and risk management.

Tip: If you decide to go down the subcontracting or outsourcing route, it’s good professional courtesy to inform your clients that someone other than yourself may be working on their project.

Setbacks

A final and essential future-proofing exercise is learning how to handle setbacks. Nobody said that going freelance would be easy!

Many throw in the towel at the first stumbling block rather than mastering perseverance. In order to survive challenges, you need perspective, commitment and support.

It’s important to accept that, at some point, something will go tits-up. This isn’t to say you should spend every day in fear of disaster, rather that by being prepared, you can balance your reaction with your expectations.

Bad reviews or the loss of a contract can be so hurtful that you lose perspective of the situation. But by recalling why you’re doing this and all your previous successes, you can motivate yourself to carry on.

A decent support network can also give you the confidence to move past difficulties. Whether it’s friends, family or a professional mentor, don’t be afraid to discuss the challenges you’re facing and ask for help, even if it’s just a sympathetic ear and some encouragement.

So there you have it – the naked truth about going freelance and how to become an entrepreneur.

We’ve given you the tools to choose if this is the right career move for you, and a roadmap to getting started. Ultimately, it boils down to the energy you can put in, your willingness to persevere through challenges, and your ability to blow clients’ socks off.

With those ingredients, we’re sure you’re going to be a star.

Been freelancing since 2008 and it is amazing!!!

I want to do freelance work but the idea still makes me anxious